If you have been planning to bring your business to international level, and you consider potential benefits of the jurisdiction of the United Arab Emirates, you will be surprised by opportunities offered thereby. Company incorporation process in the Emirates entails tax benefits, and great opportunities of obtaining residence visa for you and your family.

Unlike ordinary visitor and tourist visas, residence visa has relatively different legal status and provides the owner with a number of advantages and additional opportunities.

The following benefits of resident status should be stated:

- Eligibility for unrestricted visits to the United Arab Emirates;

- Lawful and unrestricted residence;

- Opportunities relating to tax residency in the UAE and all other related tax benefits.

Consequently, having obtained residence visa, you are entitled to work, live and visit the United Arab Emirates. It is worth noting that, if visa execution is carried out over incorporating of legal person, there are practically no restrictions in terms of nationality of shareholders and company directors.

Furthermore, at the moment, the laws of the Emirates prescribe no quota system with respect to migrants arriving into the country. First, it indicates that there is a possibility of also obtaining residence visa for family members of a foreign national.

Residence visa may be issued in Ras Al Khaimah, the UAE, to shareholders and directors of companies incorporated in the Emirate. Furthermore, residence visa is issued to members of their families.

Onshore and offshore companies - what to choose

If you intend to incorporate a company for obtaining residence visa, you should be aware of main differences between onshore and offshore companies incorporated in the jurisdiction of the Ras Al Khaimah Emirate, the United Arab Emirates. For example, in order to obtain residence visa you might need to register onshore company, since offshore company under applicable laws are not eligible for such option.

When issuing residence visa the following factors are taken into account:

- Type of company and total size of its office;

- Type of company business license;

- Economic Zone, where company operates.

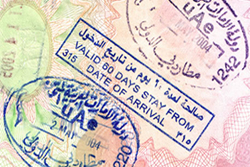

Validity term of residence visa

Residence visa in the Emirate of Ras Al Khaimah is issued for up to three years, and upon expiration thereof it may be renewed. Visa with resident status is subject to renewal provided that the qualifying person visits the Emirates at least twice a year. Visa renewal procedure is subject to statutory immigration fee, paid upon submission of visa renewal application.

The procedure to receive the residence visa may take 2-3 weeks, including issuance of residence permit to the applicant and incorporation of the company.

Legal residence in the country – guarantee of safety and comfort

When residing abroad, it is important to comply with current laws and regulations. It is especially important for migration and customs regulations. For example, illegal residence in the United Arab Emirates may entail adverse consequences for the offender, e.g. significant penalties and even imprisonment.

The best option, which ensures long-term legal residence in the Emirates, is residence visa

Resident status in the Emirate of Ras Al Khaimah provides additional opportunities and benefits.

- Reside and get employed on the territory of the Emirates;

- Operate business and perform commercial activity;

- Obtain visa for permanent residence of your family members.

Owners of resident visa may open bank accounts in the territory of the Emirate of Ras Al Khaimah. Local and foreign banking institutions are ready to offer a full range of modern banking services. Official execution of contractual relations, transport or accommodation lease is available. Furthermore, you may also obtain driving license.

It is necessary to pay attention to the main advantage of resident status in UAE – full exemption from taxes. Residents of the country, whether individuals or legal persons, are fully exempt from income tax. International agreements for avoidance of double taxation are signed between the United Arab Emirates and a number of counties allow to optimize tax payments at home.

Main requirements for obtaining residence visa

Visa and residence permit issuance procedure is simplified to the maximum extent and is not complicated. Simple procedure for obtaining residence visa in Ras Al Khaimah has been the main reason why the constantly growing number of people are wishing to stay here permanently. The main condition to keep the visa validity is to visit the country at least once every six months.

In order to obtain resident visa of Ras Al Khaimah without any complications, you should have minimum knowledge of national specificities and current immigration regulations. If you face any difficulties, or you are interested in obtaining residence visa to the United Arab Emirates, we are ready to provide relevant advice and professional support.

We have all the required resources for providing support in the process of company incorporation and for obtaining residence visa and subsequent residence permit. If you choose us, you may be assured - all our procedures are carried out strictly in compliance with current laws and are designated for resolving strategic objectives of your business.

Moreover, we are ready to provide legal support for your business in future - you can always rely on professional legal support in various business areas. We will help you choose the best business structure and thoroughly understand current laws and regulations.

In terms of obtaining residence visa - we provide full support for obtaining and further renewal thereof. In order to sign all documents for company incorporation and application of the resident visa it is enough for you to visit the Emirates only for 2 days, the rest of the works, related to completion of incorporation of the company and execution of permanent visa, will be performed by our professional and experienced specialists.